Did Albert Einstein say we only use 10% of our brain?

Probably not. It has been misattributed to Einstein to explain his great intelligence. The idea being that if only we used more, we would unlock the powers of our mind, become mathematical geniuses, perhaps even become telekinetic. Unfortunately, even when we think we are being lazy, like sleeping, our minds are quite busy.

It has been misattributed to Einstein to explain his great intelligence. The idea being that if only we used more, we would unlock the powers of our mind, become mathematical geniuses, perhaps even become telekinetic. Unfortunately, even when we think we are being lazy, like sleeping, our minds are quite busy.

Is all hope lost? Are we stuck with the intelligence we have? Probably a good education does not hurt and cognitive scientists have identified two methods that can push our brains further. The first involves focus. By concentrating on a single task, you can use more of your brain and tackle those complex mathematical formulae. The brain is usually very distracted.

The second strategy is optimisation. It involves letting your brain find the optimal solution by stopping to think and considering many alternatives before jumping on one answer.

Creativity can use a totally different ball game. Sometimes it is best to let your brain wander and simply consider all alternatives. Our brain is too complex for a few basic strategies to apply to all situations.

Why did humans develop a large brain?

“Of all animals, man has the largest brain in proportion to his size” — Aristotle. Dr Yves Muscat Baron shares his theory on how humans evolved large brains. The theory outlines how gravity could have helped humans develop a large brain — the author has named the theory, ‘The Gravitational Vascular Theory’.

Attention, Research ahead!

B yDr Ernest CachiaContinue reading

Europe, inflation, interest rates, and a financial crisis

The world is currently going through the greatest financial crisis since the 1930s. To reverse the economic crunch, central banks lowered the rate of interest to reverse the slowdown in credit availability, a popular economic policy. Such approaches are based on solid economic theories. However, the unique crisis could have really changed how economies react.

Stephen Piccinino (supervised by Professor Josef Bonnici) analysed the relationship between inflation and interest rates in the euro area between 1999 and 2011. The economic theory called the Fisher effect defines this relationship, and assumes that if a central bank injects money too quickly into an economy it would simply raise the rate of inflation.

From January 1999 to August 2008, the Fisher effect held true and the rate of inflation increased with the rate of interest in a one-to-one fashion. While between September 2008 and March 2011, this relationship fell apart due to intervention by the European Central Bank (ECB). The ECB lent retail banks large sums of money at favourable rates. It also removed limits on how much banks could borrow and reduced interest rates. These changes influenced the relationship between interest rates and inflation.

During this period, inflation rose faster than interest rates, which meant that money held in bank accounts had a lower return than in previous years. These findings mirrored the Federal Reserve’s policy interventions in the US between 1979 and 1982.

Find out more HERE.

This research was undertaken as part of a Bachelor of Commerce (Honours) in Economics.

The making of Offshore Wind Energy

Malta has a problem. It relies heavily on fossil fuels such as oil to meet its energy needs. Whenever oil prices increase, either the people or the government take the brunt of the cost. The country also faces a strict deadline: by 2020 it needs to supply 10% of its energy needs from renewable sources such as wind, solar, or wave. To help reach this goal, a new project at the University of Malta is custom-designing offshore wind turbines.

Malta’s territorial waters are quite extensive but deep. The Hurd Bank area is the most suitable site at a depth of 50 to 70 metres. These depths are beyond the reach of current commercially available technology and the latest project in the windy, turbulent North Sea reaches 45 metres (The Beatrice

Project).

To construct a wind turbine for the Maltese region, Thomas Gauci (as part of a team consisting of University academics and industrial partners) is designing a structure specific to Malta. Seventy-metre deep waters will increase costs. On the other hand, the Mediterranean is relatively calm compared to the North Sea, so the support structure keeping the wind turbine in place can be lighter, which shaves off tons of raw materials and reduces the final price.

An offshore wind turbine needs to resist waves, corrosion, and storms. The design process of an offshore support structure is essential to keep it in place and starts with determining exactly where the turbines will be embedded and how they will be supported. After these questions are answered, the turbines’ exact specifications need to be determined, such as material, height, width, and what forces it can resist over a number of years. Speed of blade rotation also needs to be checked to make sure it does not cause discomfort to nearby humans and animals. Mr Gauci’s concept design meets all of these needs in compliance with international and EU standards. At this stage, the design needs to

be costed, right down to the installation and maintainance of the turbines.

If Malta builds these offshore wind turbines it would easily meet the 10% baseline set by the EU. Undeniably, such a large project will face numerous challenges, but perhaps Mr Gauci said it best: “not a day goes by when I don’t learn something new.”

Read more HERE.

This research was performed as part of a Masters of Science from the Faculty of Engineering

and is supported by MCST (Malta Council for Science and Technology).

On Bulls and Bears

Hedge funds are pooled money that has few investment restrictions. The money usually comes from pension schemes or university endowments and their flexibility allows good hedge fund managers consistently net high returns. Hedge funds always beat the market, or so states economic theory. Simon Psaila (supervised by Mr Joseph Portelli) analysed markets from the 1990s up to the recent financial crisis finding a much more complicated scenario than is generally perceived.

The 1990s were a bull market, so called for having a consistently upward trend.

In this confident atmosphere, it was found that hedge fund managers did not outperform other market indices, such as the Standard & Poor 500 — an index of 500 stocks of companies in the USA. The same was evident for the bull market of the mid 2000s. Only when the markets dipped into a bear market (downward trend) in the early 2000s did hedge funds perform better than other strategies. The reverse occurred during the recent recession starting in 2007, which proved problematic for hedge funds and many investors pulled out of the industry.Taken as a whole, this analysis shows that hedge funds do not consistently perform better than other strategies and depend on the market environment.

In this confident atmosphere, it was found that hedge fund managers did not outperform other market indices, such as the Standard & Poor 500 — an index of 500 stocks of companies in the USA. The same was evident for the bull market of the mid 2000s. Only when the markets dipped into a bear market (downward trend) in the early 2000s did hedge funds perform better than other strategies. The reverse occurred during the recent recession starting in 2007, which proved problematic for hedge funds and many investors pulled out of the industry.Taken as a whole, this analysis shows that hedge funds do not consistently perform better than other strategies and depend on the market environment.

This study was performed as part of a Bachelor of Commerce (Honours) at the Faculty of Economics, Management and Accountancy.

Banking sectors that bounce back

In 2007, the banking sector collapsed. Today, several banks are still struggling to stand on their own two feet. To help shore them up against recurrent catastrophic collapse, the world’s top Group of Twenty economies has proposed a new set of regulations called the Basel III regulatory framework. Local analysis of this framework hints that while beneficial, it would not prevent another bust.

Governments needed to bail out banks in 2007 because banks could not pay back their loans. Banks must make sure that they maintain a ratio of capital (some form of money ranging from property to shares) to the amount of money they lend, called capital ratio. The minimum currently stands at 4% (Tier 1), meaning that banks only need to hold less than one in twenty of the money they are lending, which does not leave much of a ‘cushion’ if things go wrong. A bank’s liquidity can quickly dry up damaging other banks.

The Basel III framework introduces a new set of standards that amongst other things raises the minimum Tier 1 capital ratio to 6%. Marica Bonavia (under the supervision of Mr Michel Said) assessed the impact of the new framework on the American and European banking systems. Her work reveals how the largest American banks already conform. On the other hand, the position of European banks ranges from German banks that are raising new capital, to Swiss and British regulators who want higher capital ratios.

The dissertation suggests that the real impact of Basel III still needs to be seen and although the new regulations are a big step forward, further efforts are needed.

This research was performed as part of a Bachelor of Commerce (Honours) from the Faculty of Economics, Management and

Accountancy.

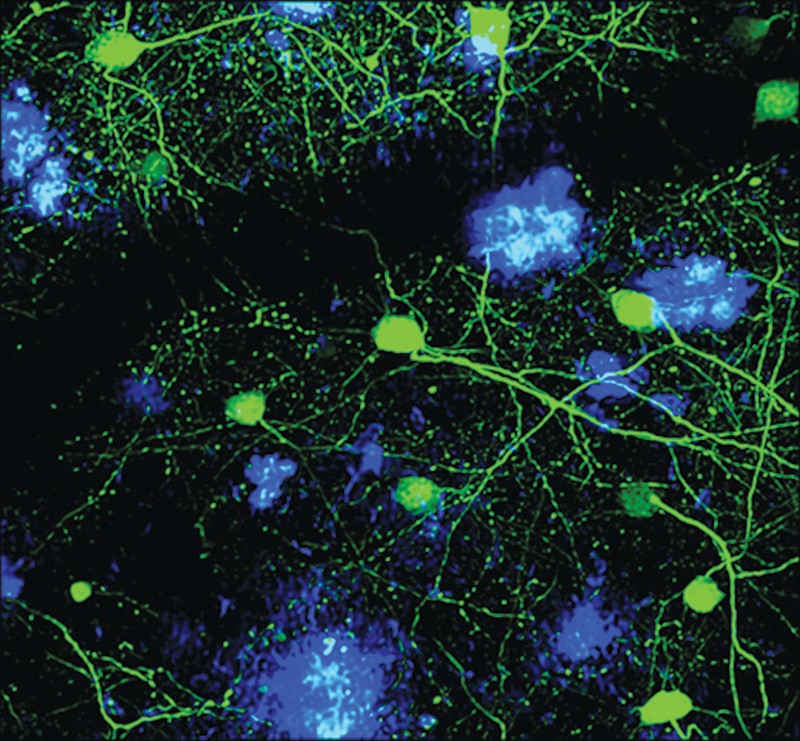

Cocaine leads to information overload

Cocaine can hijack the brain.

Once taken, recovery for a user is a long and difficult road, with life threatening risks and ruined social interactions hindering their ability to stop taking the drug. Research from the University of Malta has now revealed a possible explanation for cocaine relapse.Around the world, 21 million people take cocaine. Unfortunately, even one-time or occasional users can become addicts. This makes recovery a lengthy lifelong process with numerous challenges. Regardless of how tough a user is or how hard they try, relapsing after detoxification or rehabilitation always remains a sombre possibility.

To discover why cocaine addicts are prone to relapse, Roderick Spiteri (supervised by Prof. Richard Muscat) compared 19 cocaine users to 19 average individuals. Using methods developed in Bordeaux, both groups were tested on their ability to filter out useful information from a torrent of noise. For people to function they need to extract information by blocking irrelevant clatter. This prevents sensory and cognitive overload. When an individual attempts to deal with too much information it leads to errors and poor choices.

The research shows how cocaine users lose their ability to block irrelevant information that leads to cognitive overload. This is like a virus causing a computer system to crash, leaving only one choice: restart. Sadly, the same cannot be done for a cocaine addict. Cognitive overload leads to an inability to choose, usually leading to bad decisions. Integrating this new knowledge to psychological treatments like cognitive behavioural therapy might help addicts on the long road of recovery and social integration. If everyday situations are likely to overwhelm a cocaine user’s brain, they may need more frequent breaks between tasks in order to cope. •

This research was performed as part of a Masters in Biomedical Science from the Faculty of Medicine & Surgery.