Filling in an FS3 form (Statement of Earnings/Tax Return forms) is already a headache, but imagine trying to prepare accounts for a small business. It is a time-consuming and laborious process, and doing things by hand can lead to serious mistakes. Why haven’t we automated accounting yet?

Unfortunately, automating accounting is trickier than you might think. Computers struggle to pick out what is important in paper documents like receipts, which makes it challenging to automate. An anonymous accountant entrenched in these daily operations brought to light this very observation, sparking the inception of the Automated Document Analysis and Classification for Enhanced Enterprise Efficiency (ADACE3) project.

ADACE3 is led by UM academics Prof. Adrian Muscat and Prof. Ing. Gianluca Valentino in partnership with PTL Ltd, a leading technology company, and funded by the Malta Council for Science and Technology (MCST). Their objective is to develop a minimum viable product capable of undergoing field testing and eventual commercialisation.

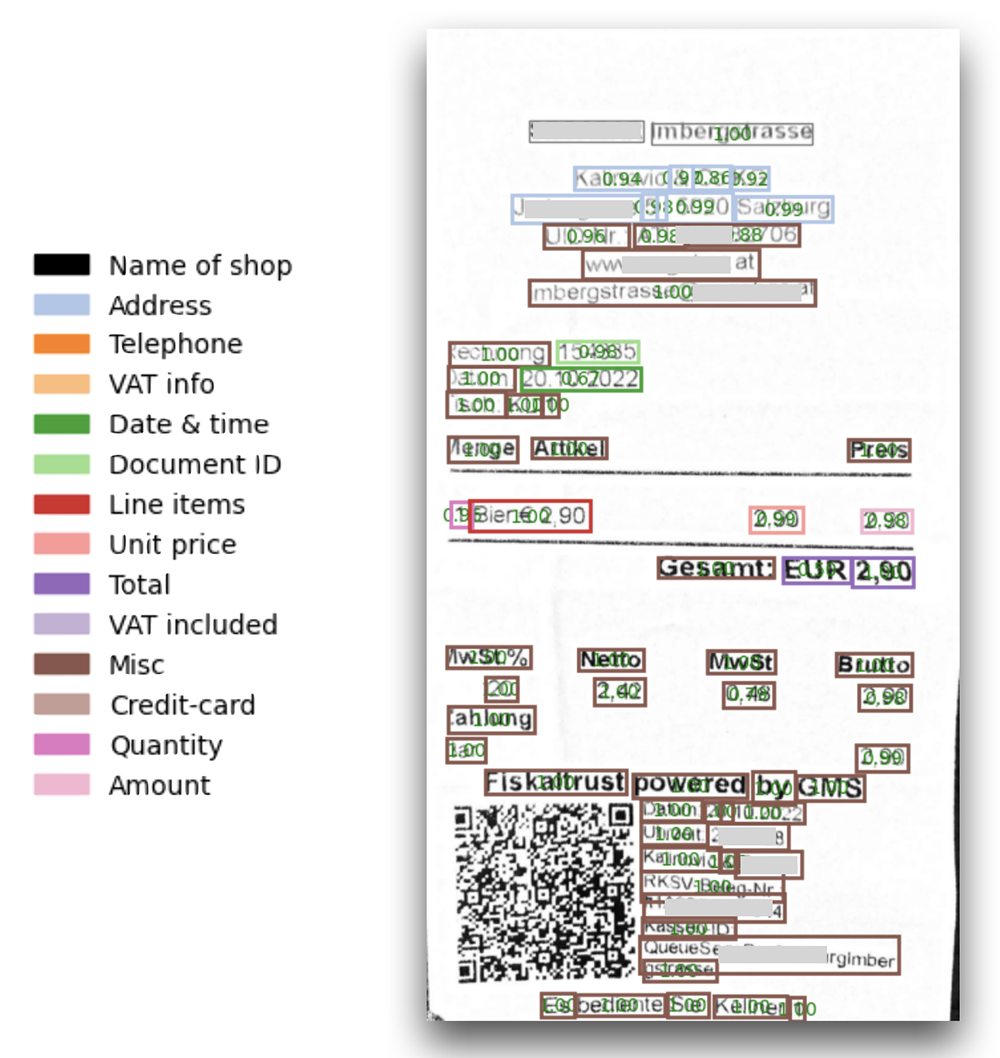

Traditional products (other commercial software solutions) commonly used for bookkeeping and accounting tasks often suffer from limited functionality, requiring frequent human intervention that hinders further automation. However, what makes the prototype developed through ADACE3 so particular when compared to currently available commercial products is its advanced AI capabilities. The first step in the processing pipeline is to perform Optical Character Recognition (OCR) to digitise the documents. It then uses a state-of-the-art AI model, LayoutLM, to perform semantic segmentation to analyse and categorise the text based on its meaning – transforming how information is processed and understood. Muscat states:

‘Off-the-shelf commercial products are either characterised by limited functionality, increasing the incidence of human intervention and limiting further tasks or require the periodic intervention of higher-order skills to re-train and maintain a working system.’

Saving time and headaches

Before an AI can fill in your accounts, it must first ‘understand’ what your receipts say. This is called document analysis. In simple terms, document analysis involves systematically reviewing and extracting information from documents. This process is used across various fields, from science to history, and is increasingly automated to handle large amounts of data. Valentino comments:

‘The accurate, automatic extraction of information from documents such as invoices and receipts will go a long way towards speeding up the preparation and reconciliation of accounts, while reducing human error.’

ADACE3’s approach, therefore, supports businesses in achieving more accurate financial reporting and improving their operational efficiency. This enhancement is particularly crucial for small businesses that traditionally rely on more manual systems.

Challenges in Development

Throughout its development, ADACE3 faced significant hurdles, notably the absence of a suitable labelled dataset for training the AI model and the poor quality of scanned images from receipts printed on thermal paper, where fading ink over time is a common issue. Despite the adoption of e-invoicing standards designed to simplify processes, Valentino noted that ‘most companies, especially the smaller ones, still make exclusive use of either paper, email, or PDF invoices, receipts, and purchase orders.’ These formats do not allow for semantic information to be easily accessed by machines, thus limiting automation.

These challenges necessitated the creation of a new dataset and adaptations in the technology to handle low-quality images effectively. ADACE3 addresses this gap by enabling the machine to ‘understand’ and process semantic information, setting the stage for broader automation applications across the industry.

From Idea to Investment

The ADACE3 team is actively preparing a business plan to transition from a successful research and development phase to commercialisation. The next steps involve engaging with potential investors to discuss the development of a minimum viable product, which will likely lead to field testing and eventual market introduction. This phase is crucial for making the software widely available, ensuring that businesses of all sizes can benefit from this innovative technology.

The ADACE3 project is at the forefront of innovation in bookkeeping and accounting. By leveraging state-of-the-art AI algorithms, the team aims to minimise manual intervention and enhance efficiency in financial management processes. With promising results already achieved and a roadmap for future development, the ADACE3 project embodies the potential to shape the future of accounting.

The research support officers who contributed to this project are Xandru Mifsud, Leander Grech, Adriana Baldacchino and Said Boumaraf.

The ADACE3 project is funded by the Malta Council for Science and Technology’s MCST-FUSION R&I Grant.

Comments are closed for this article!