In 2019, 2.8 million tourists came to Malta and spent on average over €800 each. Maltese households spent in total €826.8 million on eating out and takeaways in 2018. In March 2020, the COVID-19 global pandemic arrived in Malta. Subsequent containment measures swept most of this spending away. Prof. Joseph Falzon crunches the numbers of the predicted economic impact.

In March, the Treasury Secretary (Finance Minister) of the USA, Steven Mnuchin, stated that unemployment could reach 20% – only 5% short of Great Depression levels (1930s). It got me (Prof. Joseph Falzon) thinking about the possible effects on Malta.

In the 1930s the global Great Depression taught us that only massive monetary and fiscal stimulus can help economies recover.

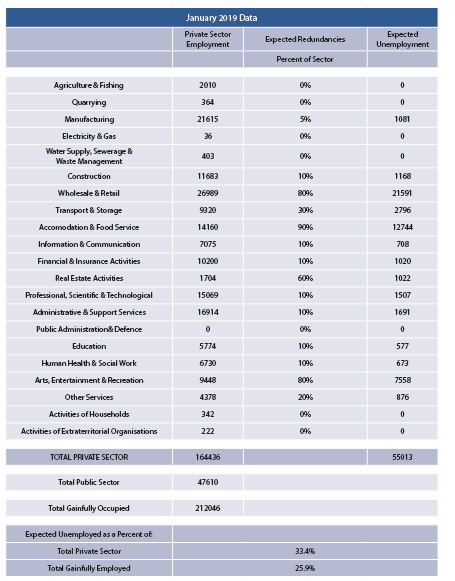

I have been working with models of the Maltese economy for 36 years, and I can confidently say that Malta is very likely to experience a very deep recession. To come up with my estimates, I used the National Statistics Office’s last published economic data (January 2019).

I looked at the 21 different sectors in our economy and analysed those gainfully employed in the private sector. Although employers’ representatives demanded cuts, I am assuming that public sector employees will continue to receive their full monthly paycheck. The 47,610 employees in the public sector will not lose their jobs either. Although some parents might decide to work reduced hours to take care of their children while at home, which would reduce their income, the real potential for depression hinges on the private sector.

Predicting the slump

For each sector, I estimated the number of redundancies based on the model I used for the Maltese economy (see the table) in the different employment sectors. The accommodation and food service sector will be one of the worst hit (90% redundancy). Arts, entertainment & recreation will suffer as well (80% redundancy). Research, education, and health work will suffer minimally (around 10% redundancy). A few lucky ones will come out of this with no reductions at all.

These probabilities are subjective. I invite the Government, employers’ representatives and trade unions to use this model to compute their own estimates. These expected rates of redundancies can be continuously monitored and updated as the coronavirus effects change over time.

My initial estimates showed that 55,000 employees could potentially be laid off or experience drastic reductions in their salaries. This figure is 33% of all persons employed in the private sector (164,436), and 26% of all gainfully employed in Malta (212,046). For migrant workers, unemployment may mean they will have to leave Malta, reducing the overall demand for food, personal necessities, and accommodation.

Research, education, and health work will suffer minimally (around 10% redundancy).

A 26% decline in employment and income implies that our GDP will shrink from €13,208 million in 2019 to €9,774 million in 2020, a reduction of €3,434 million on an annual basis. If the coronavirus effects last three months, the reduction will be one fourth of this figure (€858 million), and if they continue for six months, the reduction will be half of this figure (€1,717 million).

The decline in GDP will not occur uniformly across all sectors. Some sectors, like accommodation and food service, wholesale & retail, and arts, entertainment and recreation, will see rapid decline, forcing vast layoffs and/or huge reductions in employee incomes. The government itself will see big reductions in income tax revenue, national insurance contributions, and VAT, probably also close to a 26% reduction on an annual basis. After I published my estimates, it was reported that the government has suffered a fiscal deficit of €312.5 million and a drop in revenue of €88.9 million in the first quarter of this year. In May, the European Commission’s forecast predicted that Malta’s GDP will shrink by nearly 6% this year, but will recover in 2021.

A new Marshall plan?

Employers’ representatives and trade unions have asked the government to intervene. Many countries around the world have announced huge stimulus packages. In the 1930s the global Great Depression taught us that only massive monetary and fiscal stimulus can help economies recover. To prevent a repeat of the 2008 banking crisis, the European Central Bank has already injected billions of Euros into the Eurozone economy. EU governments also need to up their spending to directly help all the sectors which will be heavily impacted by the coronavirus pandemic. The commercial banks also need to offer liquidity measures, with very low interest rates, to all businesses in difficulty.

After I published my estimations on the newspaper MaltaToday, the government announced €800 monthly support per month for the most impacted workers. In total, the government supported 110,000 workers impacted by the virus (double my estimates of 55,000 workers). Full cooperation with health authorities is essential for containing the virus, so the government rightly stepped up to make sure that most workers do not risk their lives to earn their living. If we do enter a new severe recession, we will need each other’s support more than ever. Economic modelling is important, not to act as a prophet of doom, but to help a country make the right interventions at the right time to keep the country functional, economically and socially.

Comments are closed for this article!