Behavioural economics is on a global high, earning itself a prominent place in both public policy and business. Malta, however, doesn’t seem to be keeping up. Kora Muscat outlines why it should.

I’m going to offer you some money. I’m also giving you a choice that will determine how much money you get and when you get it. In the first instance, I will offer either €10 today, or €20 next week. Which option would you prefer?

Made up your mind? Okay. On to the second offer.

This time you need to choose between €10 in two weeks, or €20 in three weeks. Which option would you take?

Classical economics, the school of thought most quoted in the news, would predict that everyone who is offered the above two sets of choices, would end up with €40 by the third week. It is rational to always pick more money over less. However, numerous such experiments have shown that the vast majority of people pick €10 in the first case, and €20 in the second.

Why do people opt for less money in the first case? Even more importantly, why does classical economics fail to predict what people will actually do?

The Behavioural Economics revolution

As students endlessly hear during class, ‘classical economics’ is a normative subject, meaning it describes what people would do given a vast array of assumptions. It assumes that people are rational, that they always have all the necessary information at hand, and that they will follow their brain, seeking to optimise the objective value of every outcome. But when is this actually the case?

People make irrational choices all the time. Love is the perfect example. Men and women of all ages move forward with important, potentially impactful choices based on little to no information on probable outcomes. But there are many more such situations. Two psychologists, Daniel Kahneman and Amos Tversky, compiled lists of them, demonstrating how people behave inconsistent and predictably non-rational patterns. With that, the ‘behavioural economics revolution’ commenced.

‘Behavioural economics’ is a descriptive subject, seeking to describe how people actually behave in real life. It builds on principles that have been the norm in psychology for decades to inform classical economic theory. It also aims to model the effect of actual behaviour on market prices, returns, and resource allocation.

Why bother with Behavioural Economics?

Firstly, because it explains why we might end up with less money. Why do most people pick €10 today, over €20 next week? The reason is present bias, and refers to the tendency for people to give more value to payoffs that are closer to the present time when considering trade-offs between two future moments.

This bias has been the cause of much concern among policy makers across Europe. In Malta, for example, the ageing population and declining fertility rate have rendered the public pension scheme unsustainable. Viable alternatives are private or occupational pensions. Let’s consider the latter, where an individual pension is jointly funded by them and their employer. Most people understand the benefits: the importance of saving for retirement, tax incentives on pension contributions, and minimal salary reductions. Classical economics would assume that this is a sure win. It is rational to sign up for such a scheme. Nonetheless, uptake of occupational pension schemes has been shown to be very low in countries where employees are given the opportunity to join. Because of present bias, it is hard for people to actively decide to give up money they can get now and put it aside for a future that is too far away to even imagine.

People make irrational choices all the time and love is the perfect example.

Human beings also have another bias called the status quo bias, whereby most of us tend to resist change, preferring to stick to the way things are. Policy makers in New Zealand and the UK were among the first to leverage the status quo bias in favour of pension contributions by setting up the Kiwi Saver (New Zealand) and NEST (UK) auto-enrollment schemes. These schemes saw employees automatically enrolled into a pension scheme, and given the choice to opt out if they so wished. Results were very positive, showing that very few people actually opted out. In fact, since the scheme was introduced in the UK in 2012, by mid-2014 occupational pension scheme enrollment rates rose by 17 percentage points (from 32% in 2012 to 49% in 2014).

Through successes like the above example, behavioural economics is gaining traction among policy makers. The UK has funded its own Behavioural Insights Team to redesign public services. The team have branched out internationally and worked on projects in over fifteen countries. They now have offices in Sydney and New York. In 2015 the White House issued an executive order about the importance of using behavioural insights to serve the people. Unfortunately, Malta does not seem to have caught on yet.

Business Matters

While local policy makers don’t seem to be jumping on the behavioural economics bandwagon, perhaps the private sector will beat them to it. The application of behavioural economics in business is still in its infancy, but it is growing rapidly, particularly in the UK and USA.

This is where my research comes in. I currently work at Innovia Technology, an innovation consultancy based in Cambridge, UK. Innovia is a multidisciplinary firm that works with some of the largest organisations in the world, and behavioural economics is a relatively new discipline within it. However, during the last fifteen months, I have seen an interest and demand for behavioural economics services among these international companies grow exponentially.

On the one hand, some organisations like Unilever are developing their own in-house behavioural science capabilities. Companies with a strong online presence are increasingly seeing the value of using behavioural economic tools, like randomised controlled trials. Such trials originated in medicine to objectively measure the effect of a clinical intervention over a control group. They have been adapted for use outside of clinics, and work in very much the same way. In marketing, this is referred to as A/B testing. Many large online retail and mobile gaming companies use this technique to manipulate the way a web page looks to some viewers, while leaving it unchanged for others. Using quick and simple page manipulations, they can test whether a small change (like changing the colour of the ‘buy it now button’ on eBay) has a significant effect on sales, and it does.

Testing online behaviours is easy, but retail outlets are also starting to invest in the infrastructure to apply these kinds of tests in physical contexts. Behavioural economics has further been credited with expanding marketers’ toolkits. It has given businesses the opportunity to see what people actually do rather than what they say they do.

I know what you must be thinking: ‘That’s just what we need, businesses finding new ways to exploit their customers!’ (and if you were not thinking it before, you sure are now). There are cases where businesses will cross lines and use insights from behavioural economics to consumers’ detriment. This is unethical, and must be tackled by the relevant authorities and institutions. However, I believe that if businesses embrace behavioural economics, the potential benefits to consumers far outweigh the negatives. Marketing does a good enough job at driving sales—clients are coming to Innovia to ask for more than that. One client asked how they can make the process of boarding a plane less like herding cattle. We studied the psychology of queuing and the behavioural implications of the uncertainty associated with airports to design a more pleasurable experience for passengers.

Gillette, a leading brand of male razors and other skincare products, asked us to help them break Chinese men’s habits of dry-shaving (using rotary shavers), and convert them to wet-shaving (using razors), since the latter is scientifically proven to be better for the skin. Furthermore, a global market-leading pharmaceutical company asked us to design a program to increase medication adherence so that its consumers can get the full benefit of their drug.

Many markets have become saturated, and consumers are more sophisticated than ever. Businesses realise that they must work harder to differentiate themselves and offer value. Behavioural economics supports these kinds of initiatives.

A small change like changing the colour of the ‘buy it now button’ on eBay has a significant effect on sales.

Applying this to Malta

An issue that the vast majority of us struggle with every day is road traffic in Malta. One study shows that 93% of drivers think they drive better than the median driver, which of course, cannot be correct. This amusing effect has been called the overconfidence bias and it can be observed in all kinds of situations. Regardless of whether you think the traffic situation in Malta is your fault or somebody else’s, there’s no denying that our roads are overly-congested most of the time, and that the general population’s attitude toward driving normally leaves much to be desired.

A quick Google search makes it clear that numerous local authorities are speaking out about the issue, and many plans are in the works to rectify the situation. However, from a behavioural economics perspective, it is disheartening to see how unlikely it is that any of these plans will actually lead to significant improvements. Here’s why.

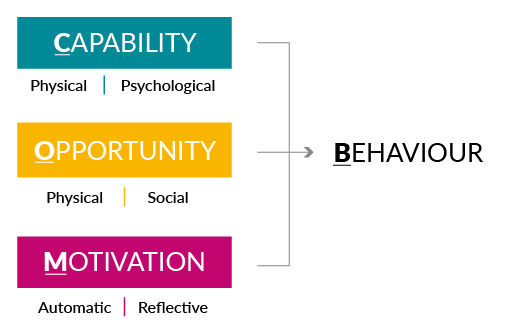

According to a well-validated model of behaviour, the COM-B, people’s behaviour is driven by a combination of three broad sets of factors; namely capability, opportunity, and motivation.

Most of the plans being proposed or debated by different authorities, like infrastructural development, improvements to public transport systems and tax deterrents only provide for improved physical opportunity. Not to say that these interventions are useless; in fact, improving public transport to provide a viable substitute for driving, for example, is an excellent starting point. However, it is far from enough to make a difference because it does not target the complex and intertwined set of behavioural drivers.

Let us take another example: carpooling. In April of last year, the Times of Malta reported that the carpooling platform, Bum a Lift, was not successful at a national level. Although the platform provided the physical opportunity to carpool, its creator correctly pointed out that a community-wide attitudinal shift was required for it to be more successful.

Many readers probably know that carpooling is good. But can you explain why exactly? How does it impact the environment? How many people does it take to make a difference to congestion? These questions are probably harder to answer. We keep hearing that traffic is a problem, but we are given much less information about what will work and how and why. Education to increase general knowledge and awareness, or psychological capability, is an important enabler.

However, capability and education still aren’t enough, as in most cases, the crucial determinant of a behaviour is motivation. Bum a Lift has been more successful with university students, particularly because it has been linked to other interventions that also make it easier for carpoolers to find parking on campus, targeting their reflective motivation (reflective processes including evaluations and plans)

There are all kinds of interventions that can be put in place to encourage more people to drive less. Messages could be printed on the back of bus tickets, informing passengers about how many fewer emissions are being released into the environment thanks to their decision to take the bus as opposed to driving. Potential carpoolers, like schoolchildren’s parents, could be given letters comparing their behaviour to that of their peers. Experiments have shown that telling someone that a proportion of their peers act in a specific, socially desirable way, makes it more likely that they will do so too.

The Way Forward

Behavioural economics is relatively new, but is growing in popularity, and has important implications for our wellbeing.

At an individual level, behavioural economics can help us understand why we act in the way we do, and help us make better decisions. At an organisational level, it can enable businesses to get a competitive advantage by creating unchartered value with consumers. At a national level, it has been proven to significantly increase social welfare.

Malta is lagging behind at its national and organisational levels. But that doesn’t mean that we cannot start the ball rolling individually. Let us study behavioural economics, discuss it, use it, teach it, and apply it so that we can drive change where it is needed.

Comments are closed for this article!